The ABC's of Annuities and answers to common questions

Annuities Explained: Here's what to focus on when you are researching annuities...

WHAT is an annuity?

WHAT is an annuity?

"What is an annuity?"

An annuity is an agreement with a licensed, regulated and audited insurance company to watch over your money and pay it back to you with interest in one of three ways: a) through steady withdrawals of 5% to 10% per year, b) through an “annuitization” (converting your lump sum to a stream of lifetime payments backed by the reserves of the company) or c) cashing out, just as you would with a bank account or mutual fund.

Annuities are similar to mutual funds or bank CDs in the sense that you are placing funds with a licensed trustee. They differ greatly from mutual funds and CDs by virtue of the fact that an annuity can be used to create guaranteed lifetime income for two spouses, much like a pension from work.

An annuity is not a market-traded asset likes stocks and mutual funds. Annuities are contracts for specific performance, which is a major benefit to retirees.

"What are the four kinds of annuities?"

There are four broad categories of annuities:

- Immediate

- Variable

- Fixed

- Fixed Index (also known by several "nicknames" — hybrid, new generation, next gen, and Next Generation)

Getting a little confused? No need for that--we'll take it step by step and make it clear for you.

Suggestion: Download our Retirement Kit for clear answers!

WHY are more people turning to annuities for retirement?

WHY are more people turning to annuities for retirement?

Why are more retiring engineers, teachers, health care professionals, managers, lawyers, accountants, and tech industry workers choosing Next Generation Index annuities for their 401(k), 403(b) and IRA rollovers?

Once upon a time, annuities were stodgy and restrictive. There were very few choices available for consumers.

Today, that has all changed. The insurance industry has made sweeping changes in the look, feel and substance of annuities. Today’s generation of retirees are embracing these new designs because they fit their lifestyle and protect for a lifetime.

The key reason annuities are gaining popularity for IRA rollovers is simple: The stock market is too risky and bonds are paying next to nothing.

Retirees are smart today. They have seen the 2000-2002 crash and the 2008 crash. They don’t want to repeat any of the mistakes they made back then and don’t want to leave their life savings in the hands of those on Wall Street who have no responsibility for the protection of their capital.

Most important, they know they can’t afford a major decline in their investments right as they retire.

The Next Generation Index annuities offered through IQ Wealth Management are issued by the nation’s leading top-tier carriers with exceptional features:

- Protection of principal

- A way to share in the increases of the market without participating in any losses

- Ample liquidity

- Retirement income growth of 6% or better

- Lifetime retirement income of 5% to 9% for life

- Very low or no annual fees

Protection for heirs: (the insurance company does NOT keep your money when you die)

In summary, the key reason annuities are in demand today is that most employers have done away with the traditional defined benefit pension plan. So, while there are still defined contribution options available – such as the 401(k), 457, TSP, or 403(b) plan – pensions are not. The most important decision you can make for your retirement is locking down and guaranteeing yourself last income to meet and exceed your expenses for the long haul, even if the market falls by 50%. The right annuity can contribute greatly to financial peace of mind, and a real sense of financial independence for both you and your spouse.

"How do I know if I need an annuity?"

In this era of shaky markets and zero interest rates, almost every person in or near retirement can benefit greatly from an annuity. The question "do I NEED an annuity" once had more relevance.

Retirements weren't lasting thirty or forty years. A female spouse of 55 years old can live to 95--in fact the odds are getting better all the time. Doesn't it make sense to make sure her income will last that long or longer?

Think about it for a moment: wouldn’t it be nice if we didn’t have to plan for recessions, inflation, or market crashes in retirement? …If only the market would cooperate and just keep going up from now on as long we live! But for the rest of your life and mine, governments will overspend, markets will overbuy, and things eventually …run into the ditch.

Which brings us to what a successful financial plan for retirement is all about. It isn’t just how much money you HAVE, it’s really about how much money you have coming IN-- and how reliable that income is. Which is why having a pension is such a benefit. But what if you don’t have one?

That’s why more retiring engineers, teachers, health professionals, and business owners are sectioning off a portion of their 401k Rollover to a principal secure NEXT GENERATION high income, low cost annuity to combine growth potential with exceptional income for life. Stop losing money. Never run out of income. Let’s meet soon.

"What should I know about comparing annuities before making my decision?"

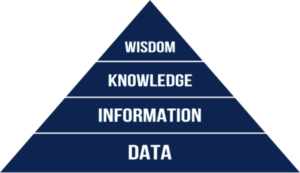

You should always consider the source of the information you are getting about annuities.

Your stock broker or a financial advisor who focuses on accumulating money on a fee basis will criticize annuities, in some cases because it takes revenue from their plate. If they do recommend annuities, it will be based on minimal research because annuities are a sideline for them. Often, a professional who is proficient in managing stocks, bonds and mutual funds for accumulating money has not spent much time studying annuities. This is reasonable and fine. That person should defer to an annuity authority who has done substantial research and comparison — AND will help you compare before settling for the first one.

"Which Annuities are Too Expensive?"

Answer:

Variable annuities. Brokers will usually only be offering variable annuities. Variable annuities tend to be very expensive and do not protect principal from loss. There are many moving parts and many fees. We don't recommend them for most people.

Sources like Ken Fisher who “hate annuities” and think you should, too, obviously are using a disingenuous scare tactic to get visitors to their website, where they can pitch their management services for annual fees that are typically 1% to 2% annually.

Annuities are the only contractually guaranteed income and preservation vehicles in the financial world. They pose competition to those who want to push a "Wall-Street-only" agenda.

The crusty old billionaire who hates annuities:

He just wants to sell you something else, of course.

Billions of dollars a year go into annuities--for a very good reason: Common Sense.

An annuity strategy can be the core and the foundation of a sustainable retirement strategy. It never relies on the stock market going up and still pays you income when the market goes down.

The right annuity can perform the function that bond funds are no longer equipped to perform.

"What type of annuity is best for an IRA rollover?"

Answer:

While any of the four kinds of annuities can be used for your IRA rollover, the fixed index Next Generation variety offers a compelling combination of principal preservation, combined with exceptional income and the opportunity to grow capital based on the upward movements of market indexes. Your money is never subjected to stock market losses.

We do not view variable annuities as the optimal choice, since the stock market’s risk is currently at an all-time high, and the annual fees can be 3% to 4% annually — FOR LIFE. In that regard, we definitely agree with Ken Fisher. He has said that variable annuities are too expensive to grow any money in retirement. We agree!

Documented statistics on fixed index annuities, by such sources as the Wharton School of Business and others, clear show a more optimal choice for the conservative to moderate investor looking to simplify their lives, increase their income and lower their fees.

Remember, only a part of your money goes to the annuity. You still are left with plenty to invest as you see fit.

The Next Generation index annuity makes for an excellent IRA, 401(k) or 403(b) rollover.

If you’re looking to get off the stock market roller coaster and upgrade your retirement income replacement strategy, we can help you compare and make a wise choice.

Let's meet soon to review and learn.

Let's meet soon to review and learn.

Call Barb for your complimentary appointment: 800--551-8994

HOW?

HOW?

Do you compare the benefits and features of each type of annuity? How can you make sure your heirs are protected? How can you protect your principal while growing your income at 6% or more?

How do you compare the benefits and features of each type of annuity?

Annuities are not traded like stocks, bonds and ETFs, so they don’t appear on exchanges.

Many investors have gotten used to being able to compare the more than 5,000 stocks and the 15,000+ mutual funds and ETFs by going to sources like Yahoo and Morningstar.

Variable annuities are the one type of annuity that does contain mutual funds within. The reason they don’t appear on exchanges is that each customer can pick a different set of mutual funds and each will be “down” or “up” by a different amount each day.

That’s why it’s imperative to work with a fiduciary advisor who is skilled and deep on knowledge with all four kinds of annuities: immediate, variable, fixed and fixed index.

The trouble is that not all advisors keep track of more than a handful of annuities.

At IQ Wealth Management, the sponsor of MyAnnuityGuy.com, you can be sure that you will be getting information based on a comparison of over 1,200 annuities or more, based on our proprietary GPS system.

Simply schedule your free, no-obligation review. (480) 902-3333

How can you make sure your heirs are protected?

The kind of annuity that can disinherit your heirs if you aren’t clear is the immediate “life-only” annuity. The other types of annuities can make sure you and your heirs get everything out of the annuity you put in, plus interest.

Your spouse can be named a guaranteed lifetime income beneficiary, paying her or him steady non-diminished income for their lifetime.

You can also easily set up — with our help — a “stretch” annuity IRA. This will allow your heirs to receive annuity income over their lifetimes. For more information, call us at (480) 902-3333.

How can you protect your principal while growing your income at 6% or more?

To meet the demand for more flexibility and control, life insurance companies have developed a great benefit known as a lifetime income rider that can be added to a variable or fixed index annuity.

In a nutshell, the income rider gives you the right, but not the obligation, to start receiving lifetime guaranteed income that you can never outlive.

With many riders, you do not have to “annuitize” to get the benefit. Annuitizing means converting your lump sum into a stream of payments irrevocably. Most people don’t like the idea — which is why the income rider feature is now prevalent.

CONSUMER ALERT: Income riders vary greatly. Do not settle for the first one you see. The difference between income rider payouts can vary by 30% to 40% among different carriers! There is no uniformity in payout. Each company has a different set of priorities and mathematical payouts.

At IQ Wealth Management, we will take the time to make sure you understand the varieties of annuities and how each works. We can simplify the process and even make it fun to choose the right annuity for you.